-

Projects reporting High or Medium-High delivery confidence

More than half of the Tier 1 and 2 projects are on track

Projects reporting Medium-High or High delivery confidence

Total projects (Tier 1 and 2) 62 Number with High or Medium-High delivery confidence (see table note) 38 Percentage with High or Medium-High delivery confidence 61.3% Total budget with High or Medium-High delivery confidence $7.3 billion Table note: High or Medium-High delivery confidence indicates projects are on track to deliver agreed outcomes.

-

Preparing senior leaders to lead digital projects successfully

Senior Responsible Officials (SROs) for digital projects ensure timely and budget‑compliant delivery of benefits to Australians. To support these officials, a mandatory program is commencing early this year to ensure they are equipped to confidently lead digital projects successfully. This program includes a simulation of a digital project across its life with a focus on building capability in assurance, benefits management, governance, project remediation, and commercial acumen. Following final trials, the program will be available through the Australian Public Service Academy and mandated for all leaders of the major digital projects included in this report.

High demand for experienced staff

The successful delivery of digital projects relies heavily on the ability of the Australian Public Service (APS) to attract and retain specialist skills. However, in the 2023–24 State of the Service Report, over 80% of agencies indicated a critical skill shortage in digital and ICT skills.

Recognising the crucial role of technology vendors in delivering the Australian Government’s ambitions for digital transformation, the Digital and ICT Investment Oversight Framework includes ‘sourcing’ as an area of focus. As part of this, the DTA coordinates marketplaces and agreements designed to enable agencies to easily access technology goods and services to support their digital projects. In 2023-24, the Australian Government sourced more than $6.35b of digital products and services from industry via these marketplaces and agreements. By accessing these arrangements through the BuyICT platform, agencies benefited from the Australian Government's collective buying power and strengthened terms and conditions.

The DTA's latest ICT labour hire and professional services panel, the Digital Marketplace Panel 2, adopts the APS Career Pathfinder dataset and Skills Framework for the Information Age (SFIA) to classify ICT labour hire opportunities. The classification of roles and greater panel pricing transparency provides clearer signals for in-demand skills, their costs and potential shortages that will inform delivery capacity and confidence in digital projects. The top in-demand digital and ICT skills sourced by the APS include software engineer, solution architect and business analyst.

-

Image description

Placeholder

Off -

-

-

Most (75.9%) of the 29 Tier 1 and 2 projects entering oversight since February 2024 report a High or Medium-High delivery confidence. These projects commonly report factors contributing to their delivery confidence rating at the start as: establishing effective governance early; having well-prepared documentation and artefacts; and ensuring experienced and capable personnel were ready.

There are early signs that investment to strengthen digital project design processes is increasing overall delivery confidence.

-

Image description

PLACEHOLDER

Off -

-

-

Some continuing projects are reporting delivery difficulties

Of the 16 continuing projects that reported delivery confidences in February 2024, 11 projects either maintained or dropped in delivery confidence to Medium or lower in February 2025. These projects are routinely managing 3 or more delivery challenges that affected their assessments. Common trends include: financial pressures; scope complexities; resourcing constraints; tight schedules; technical issues; and a need to improve project management maturity.

While the goal is to see DCAs improving over time, it is common for delivery issues to worsen before they improve, especially when complex technical issues are involved. Some projects reporting lower DCAs are depending on the successful delivery of other projects as a part of a wider reform program. While they have been closely monitoring delivery, setbacks in other projects can result in these projects being delayed, as key components they need to stay on track become unavailable when needed.

Realising a ‘finger on the pulse’ to enable timely support and course corrections

In July 2024, a the DTA began a Project Data Reporting Standard (PDRS) trial. The trial is testing a new approach to enable more seamless and timely central tracking of project performance across the Australian Government, using ‘natural systems’.

Using ‘natural systems’ means project data is collected from internal reporting projects are preparing for their governance boards, rather than requiring agencies to prepare specific reporting for central tracking purposes.

This approach is:

- improving the quality of reporting and advice the DTA can provide to stakeholders across the Australian Government – including by enabling data to be collected more frequently

- supporting decision-making by ensuring digital governance boards consistently have the minimum necessary information required to enable good decisions (a condition of the trial is that a minimum set of information must be provided to the board)

- improving the experience of agencies providing data to the DTA in our oversight role.

The trial is enabling more timely and effective central oversight of digital projects, helping ensure support can be provided where it needed most and at the earliest stage when the chance of charting a course back to green is greatest.

-

Downloadable resources

-

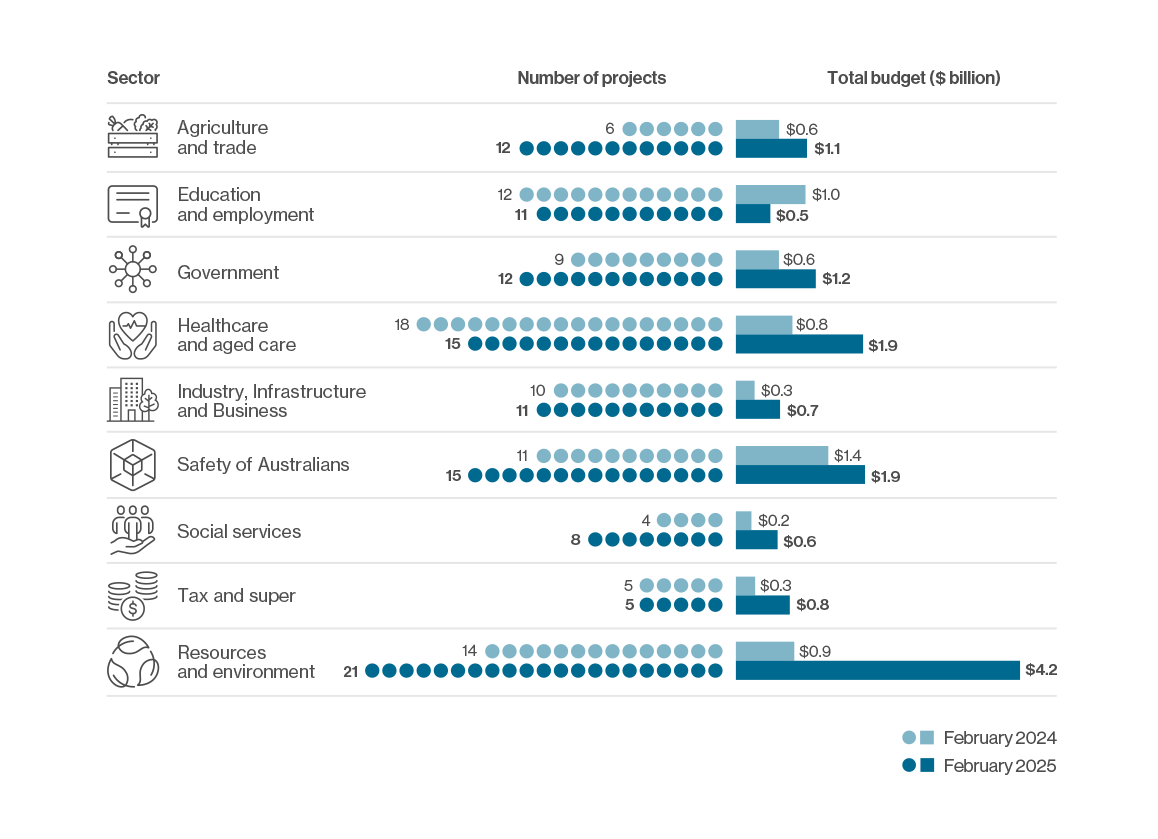

Investment by sector

This section explores the projects underway across the Australian Government through a ‘sector’ lens.

Number of projects and total budget by sector

Digital projects under the DTA’s assurance oversight are improving systems and services across 9 sectors. A common thread across all sectors is investment to improve agency systems to meet digital standards and enable them to provide simple, secure and seamless services to Australians.

Project numbers and budgets have increased in most sectors.

-

Image description

PLACEHOLDER

Off -

-

-

Appendix

-

Image description and download

PLACEHOLDER

Off -

-

-

Delivery confidence and duration of closed projects

Finishing up – how projects leaving the portfolio performed

-

Image description

PLACEHOLDER

Off -

-

-

Of the 13 Tier 1 and Tier 2 projects that closed, 10 (76.9%) reported a High or Medium-High delivery confidence. Just 2 projects had a rating of Medium or lower, while one project did not report a delivery confidence rating.

Between February 2024 and February 2025, and before closing, 4 of these projects improved their delivery confidence, and 3 projects stayed the same. Comparisons for the remaining projects are not possible as they did not report a delivery confidence in February 2024.

The average duration of closed projects was 2.5 years. Closed Tier 1 projects had a longer average duration than Tier 2 and Tier 3 projects. This longer average duration is mainly due to the inclusion of a closed 7-year Tier 1 project to improve weather and climate data.

Challenges and lessons learned

Projects that closed since February 2024 generally reported underspends. Those that went over budget reported issues including initial scoping not accounting for the full complexity of required work.

Some projects faced challenges in their ability to deliver against their original schedule due to delays getting bills introduced to Parliament, delays with equipment supply due to the COVID-19 pandemic, post-release issues that needed to be addressed, and additional enhancements that needed to be delivered to achieve expected outcomes.

Common lessons learned include:

- allocating sufficient time to early planning pre-implementation (preparation) stages, including ensuring a deep understanding of current state processes

- developing collaborative working relationships between stakeholders during scoping, delivery planning and decision-making – including efficient knowledge transfer and upskilling as needed

- defining project scope in as much detail as possible, to avoid confusion in deliverables and align project outcomes with stakeholder expectations

- enhancing financial management and budget control – including to enable tracking of earned value during implementation.

The importance of closure reports

Formal closure of a project is more than just the project finishing. Driving improved project performance over time requires careful consideration of how in-flight projects have performed, and how what we’ve learned should change the way projects are designed and delivered in future. Strengthened central oversight has this ‘system learning’ at its centre with the DTA ensuring lessons aren’t just identified but rather systematically learned across all major digital projects through real change which makes the difference.

Project closure reports play a vital role in this ‘system learning’ and, as closure reports have varied in quality, a closure reporting standard has been developed to ensure consistency and maximise the value of these reports.

Improving project closure reports

To formally close a project, agencies must provide a project closure report to all key stakeholders. However, some reports have included extensive information, requiring more resources than necessary, while others have provided insufficient information to accurately assess the project’s performance.

As a result, the DTA developed the Closure Reporting Standard for Digital and ICT-enabled projects. The standard provides a minimum and consistent set of information for reports based on 7 criteria – scope, schedule, budget, assurance, benefits realisation, transition arrangements, and lessons learned. By standardising closure reporting, the DTA is promoting best practice and providing the necessary information to evaluate completed projects and inform future investments.

We are drawing on expertise from across the APS and working with the Australian Taxation Office to develop templates to support implementation of the standard.

-

Image description and file download

PLACEHOLDER

Off -

-

-

Project numbers and value

Since February 2024, the resources and environment sector experienced a net increase of 7 projects and $3.4 billion growth in investment. This is largely attributed to one 35 year-long project that intends to secure the resources needed for Australia’s transition to net-zero. The government sector experienced a net growth of $0.5 billion, largely related to investment in Australia’s 19th national Census and the replacement of legacy systems to modernise Australia’s electoral systems.

Despite a reduced number of projects, the healthcare and aged care sector grew by $1.1 billion in value. This reflects investment in projects to support new vaping reform legislation, a range of COVID-19 outbreak management supports, and improvements to Australia’s healthcare settings, platforms and systems.

Delivery confidence

The agriculture and trade sector and the industry, infrastructure and business sector have the largest proportion of Tier 2 projects reporting a delivery confidence of Medium-High and higher. Most projects within these sectors are reporting as on track to deliver expected benefits.

The healthcare and aged care sector has the equal largest proportion of Tier 1 projects reporting a delivery confidence of Medium or lower. This is mainly due to capacity and legislative constraints. The DTA is working closely with the Department of Health and Aged Care to support the successful delivery of investments in this area – including by carefully managing pacing of new investment where it could compete with an already crowded delivery schedule.

The safety of Australians sector has the largest proportion of Tier 2 projects reporting a delivery confidence of Medium and lower. Technical constraints, resourcing and funding pressures are contributing to delivery stress within this sector.

It will remain challenging to secure a skilled workforce. Agencies will need to invest in new approaches to build capability in areas experiencing skill shortages. When planning and scheduling digital investments, it is crucial to account for the capabilities required to ensure projects have sufficient resources to deliver.

Across all sectors, digital projects can prove challenging to deliver successfully – but they remain critical to enable policy reforms designed to improve and even save the lives of Australians.

Healthcare and aged care

Digital services are improving the health of Australians, including the care of older people. The 15 active projects in this sector, with a combined value of $1.9 billion, reflect the recent increase in government investment in this area.

Most of the funding ($1.3 billion) is for 9 projects to improve the aged care sector by implementing recommendations following the Royal Commission into Aged Care Quality and Safety in 2021. This includes:

- improving ICT capabilities of federal agencies to enable more effective regulation of the aged care industry

- delivering a modernised system that supports aged care service providers to provide the high quality, safe care that older people deserve

- ensuring nurses are available at all residential care facilities and all aged care workers are registered on a national register

- supporting the different levels of independence and care required by older Australians.

The remaining 6 projects ($0.6 billion) are delivering new and improved health services, completing digital transformation of internal systems, and producing better online portals for Australians to access services.

Safety of Australians

The government is protecting vulnerable Australians by investing in law enforcement and online safety through 15 active projects with a combined value of $1.9 billion, being delivered across 11 Commonwealth agencies.

These projects are safeguarding Australia by:

- improving access to cross-border information and real-time risk data on dangerous individuals and organisations

- enhancing data matching capability to reduce investigation time and improve the ability to combat organised crime

- contributing to a national view of policing information and criminal intelligence

- using machine learning and artificial intelligence to significantly improve Australia’s efforts to combat illicit activities such as money laundering and unauthorised imports

- developing comprehensive registries and data lakes to store historical information to allow authorities to identify suspicious activity faster

- automating border clearance and cargo processes to simplify government services while also improving security alerts and risk information.

Other investments are improving the use of data to combat the growing threat of scams targeting Australians (see[GC1] case study on page xx), protecting myGov users by strengthened measures to prevent phishing attacks (see case study on page xx) and targeting disability insurance fraud (see case study on page xx).

Resources and the environment

The government is investing $4.2 billion into 21 projects to help protect and restore Australia’s vast and varied environment and manage the country’s natural resources.

This includes a long-term project ($3.4 billion) to comprehensively map Australia’s natural resources, including critical minerals and groundwater, to support the transition to net zero and enable responsible management of all resources. Another project (over $104 million) is helping to improve the management of water resources and responses to climate change impacts in the Murray-Daring Basin.

Another 8 projects (over $535 million) are leveraging data and technology to enable rapid action to address environmental changes. Data, information and analytics are being used to better manage and protect Australia’s natural heritage and streamline work on environmental and climate risk assessment projects. Significant investment is also supporting emissions reduction and renewable energy mechanisms.

A further 5 projects (over $104 million) are building the skills and data infrastructure needed to manage and monitor energy, water and diesel exhaust fluid markets and plan for future supply and demand.

A previous investment in this sector, which concluded in June 2024, modernised and secured critical climate and weather data services (see case study on page xx).

[GC1]For webpage view hyperlink to relevant case study pages where highlighted yellow

-

Image description and file download

PLACEHOLDER

Off -

Image description and file download

PLACEHOLDER

Off -

Image description and file download

PLACEHOLDER

Off

Connect with the digital community

Share, build or learn digital experience and skills with training and events, and collaborate with peers across government.