Guidance

Definitions

In this Policy, benefits are defined as the measurable improvement from change, which is perceived as positive by one or more stakeholders, and which contributes to organisational (including strategic) objectives (Jenner and APMG International 2014).

This means:

- Benefits are measurable and observable.

- Benefits are derived from change. In the context of this policy, change is derived from digital and ICT-enabled investments which collectively form the Digital and ICT Portfolio.

- Benefits are advantageous to various stakeholders. In the context of government-led digital and ICT investment, stakeholders include citizens, businesses, and various areas within Government.

- To be relevant, benefits need to contribute towards strategic objectives. These may include agency-specific objectives as well as broader government strategic goals.

Benefits Management is the identification, quantification, analysis, planning, tracking, realisation, and optimisation of benefits (Jenner and APMG International, 2014). It is an important change and investment discipline that, when applied effectively, increases confidence in realising intended benefits and demonstrating the success of investments.

The need for increased adoption in the public sector is based on the relatively poor track record of many digital and ICT projects in delivering the benefits they were established and funded to realise (DTA n.d.). With this in mind, uplifting benefits management maturity is a journey that requires substantial cultural change. As such, agencies at earlier stages of their maturity journey should:

- Approach benefits management with a forward-looking mindset that seeks to plan for success and learn from previous experience, rather than approaching it with scepticism and seeking to attribute blame for past failures.

- Scale benefits management activities proportionately to the investment size and complexity. It is usually impractical to measure all identified benefits of a project. Consider applying the 80:20 rule by focusing on the 20% of the benefits that typically represent 80% of the value.

- Prioritise benefits that can easily be measured using existing processes (for example, staff/client satisfaction surveys) and ICT systems. This helps keep the cost and effort to measure and monitor benefits within reason.

- Be cognisant of and actively account for optimism bias. This means, for example, that it is usually necessary to seek evidence and validation to

support benefit forecasts. - Dedicate time and resources upfront to plan for benefits management by documenting rigorous benefit baselines, targets, and realisation plans to support a compelling business case.

- Ensure that the proposed benefits are within scope of the investment to realise and are not dependent on delivery of subsequent investments.

Policy statements in practice

Policy statement 1. Benefits are aligned to strategic objectives

A key component of the definition of benefits is that they are measurable improvements from investments which are perceived as positive by stakeholders and contribute towards strategic objectives. As such, it is important to establish a clear line of sight from strategic objectives through to investment benefits (and vice versa). Benefits from investments should be expressed in consistent terms that demonstrate their strategic contribution. Only investments which are properly aligned with strategic objectives should be prioritised (unless they are compliance related).

This means:

- There is a clear link between the individual benefits the investment is designed to realise and the strategic objectives they are contributing towards. Strategic objectives include quantifiable objectives captured in an agency or department’s corporate plans. Ideally, the benefits for digital and ICT-enabled investments should also be linked to whole-of-government digital and ICT strategic objectives such as the Data and Digital Government Strategy (DDGS) and the IOF Prioritisation Criteria.

- The line of sight between strategy and benefits is demonstrated through benefits mapping techniques that explain how benefits are derived and how they contribute towards strategic objectives.

Policy statement 2. Benefits are integrated into performance management

Wherever possible, benefits (and the measures used) should be integrated into the organisation’s operational performance indicators, individuals’ performance management processes, and contractor and professional service agreements.

This means:

- Existing agency performance measurement mechanisms are used in defining benefits, baselining, and monitoring performance where they are available. Where possible, data from existing ICT systems should be used.

- Benefits are reflected in the organisation’s key performance indicators (KPIs) such as budgets, headcounts, business unit targets, strategic and business delivery plans, etc.

- Realisation of benefits is linked to the personal performance objectives of key individuals, such as the Senior Responsible Official (SRO) and Benefit Owners. This ensures that individual responsibilities and accountabilities for benefit realisation and business change are clearly defined.

- Realisation of benefits is linked to contractor performance agreements and professional service provider contracts (e.g. through value-based contracts) where appropriate.

- Benefit Profiles are owned by Benefit Owners and agreed by all key stakeholders.

Policy statement 3. Benefits are integrated into a project’s governance approach

Ownership and accountability are critical to effective governance. This statement aims to ensure that there is clear allocation of accountabilities and transparent reporting of performance. All benefits management activities should have clearly defined roles and responsibilities with documented agreement.

This means:

- The project has established a robust governance structure that heavily integrates benefits management.

- Benefits realisation is a standing agenda item at all governance board/committee meetings (at all levels).

- Roles and responsibilities for all benefits management activities are clearly understood and documented.

- Individual benefit profiles are owned by Benefit Owners and agreed by all key stakeholders.

- Benefit variation protocols and procedures are clearly defined and include tolerance thresholds for forecast and actual benefit variances, and appropriate escalation protocols.

- Regular reviews of benefits realisation progress occur throughout and beyond project delivery.

Policy statement 4. Benefits are measurable, and evidence based

Benefits, by definition, must be measurable (or at the very least observable). Even benefits that are considered intangible can often be measured via qualitative measures and proxy indicators.

If benefits are not expressed in measurable terms, it is not possible to effectively demonstrate improvement. This also means it is not possible to baseline performance which substantially weakens the case for change.

This means:

- Identified benefits are specific, measurable, achievable, relevant, timebound, agreed, and attributable to strategic objectives (SMARTAA).

- Improvements are described using verbs that tend to be measurable (e.g. using MEDIC: Maintain, Eliminate, Decrease, Increase, and Create) as opposed to vague language (e.g. improve).

- Baseline and target measures are documented and supported by robust assumptions.

- Target levels for each benefit are clearly defined and documented.

- Potential investment disbenefits are documented.

Policy statement 5. Benefits are owned by business units, not by the project

Benefits management is a collaborative effort between business sponsors, who own and are accountable for benefits realisation, and project delivery teams, who are accountable for project outputs and outcomes.

The Benefit Owner is the individual accountable for the realisation of benefits. Accountability and responsibility for benefits realisation is key for successful benefits management. It is important that responsibility for benefits realisation remains within impacted business units, as projects are temporary and business units are permanent.

This means:

- Each benefit has a benefit profile (or equivalent) that is endorsed by an accountable Benefit Owner. Re-endorsement of the benefit profile is necessary when the Benefit Owner changes.

- Benefit Owners hold permanent roles within the accountable business areas as opposed to temporary project delivery roles (or both).

- Ideally, benefit profiles also include sign off from key stakeholders, such as the SRO and the Business Change Manager, to reflect that benefits realisation requires a joint effort between project and business teams.

Policy statement 6. Benefit dependencies are explicitly understood and recorded

Projects do not lead to automatic realisation of benefits. Benefits realisation depends on business change, which is facilitated by enabling products and services, with accountabilities for each clearly defined in Benefit Realisation Plans.

This means:

- A benefits map is developed collaboratively with stakeholders to identify the benefits of the investment and how project outputs/deliverables combine with business changes to realise the benefits. Ideally, they also distinguish between intermediate and end benefits.

- Dependent business changes are captured as milestones and integrated into project management plans and relevant artefacts.

- Project change management functions are integrated with benefits realisation planning so that appropriate business change management activities are planned.

Policy statement 7. Agencies that deliver projects adopt a benefits-led culture and approach to change

The purpose of investment is to realise benefits and, as such, all change should be benefits-led. Additionally, there needs to be a shift from a delivery-centric culture, where the focus is on delivering capability to time, cost and quality standards, to a benefit-centric culture, where the primary focus is on delivering value from investments.

This means:

- Benefits realisation has the full commitment (not just curiosity or interest) of senior management.

- Projects are created for the purpose of realising the required benefits rather than benefits being used to justify a pre-selected solution.

- Investments clearly articulate the strategic benefits to be realised and the drivers for change (the problem). This will inform the project scope and minimise investment in projects that do not contribute to strategic goals.

- Early realisation of benefits is a priority, even for long-term projects.

- Incremental and modular approaches to program delivery are adopted, with quick wins being used to generate enthusiasm for the project.

- Benefits are seen as a continuous activity whereby the benefits realised and reviewed by one investment should provide valuable lessons learned and determine the starting point for similar future investments.

- There is an emphasis on looking for emergent benefits throughout the investment lifecycle.

Policy statement 8. Benefits management activities are integrated into project management activities

Benefits management must be fully integrated into project management activities to ensure project management decisions and reporting remain focussed on benefits. Benefits should not be treated as incidental to, or naturally resulting from, project management activity.

This means:

- Benefits are prominently featured in project status reporting and as a standing agenda item at all governance board/committee meetings (at all levels).

- Benefit dependencies that are identified in the benefits map are incorporated into project, risk and change management plans with accountable owners.

- Appropriate resourcing is set aside for benefits management activities.

- Benefits are integrated into communication and stakeholder engagement plans to ensure alignment of messaging.

Governance

Roles and Responsibilities

Clearly defined roles, responsibilities and accountabilities are fundamental to effective benefits management.

Some of the key roles in benefits management may include:

- Senior Responsible Official (SRO): the individual who is accountable for the overall success of the project and optimising benefits realisation

- Benefit Owner: the individual responsible for the realisation of a specific benefit. The Benefit Owner must hold a business as usual role in the organisation (as opposed to a project delivery role) as projects are transient and benefit ownership extends beyond the life of a project.

- Project/Program Manager: the role responsible for day-to-day management of the project and the coordination of change activities (in collaboration with the Business Change Manager) that enable benefits realisation.

- Business Change Manager: the role responsible for benefits management activities, preparing benefits management documentation, and embedding business change. The role is the link between the project and the business.

Note: these are roles and do not necessarily reflect job titles. The roles should be scaled to the size and complexity of the investment. For example, larger investments may have multiple Business Change Managers, or Benefits Managers may be used to support benefits management activities on behalf of these key roles. Irrespective of size and complexity, there should ultimately be a single SRO that has overall accountability for the realisation of investment benefits, and a single owner for each benefit.

Benefit Change Control

A key challenge of benefits management is the ability to trace benefits realisation back to the investment decision (i.e., business case), which is critical in evaluating the success of an investment. To overcome this challenge, it is important to document a baseline, review the baseline at critical benefit milestones, and document variations to expected benefits.

Changes may occur for several reasons including changes in project scope, changes to project schedule, and emerging risks and issues.

When considering project changes, the impact on benefits must be considered. This requires benefit variations to be integrated into project governance mechanisms for appropriate consideration, buy in and approval. All benefit variations must, at a minimum, be signed off by the SRO and Benefit Owner.

References

- Jenner, S and APMG International, 2014, Managing Benefits: Optimizing the Return from Investment, The Stationery Office.

- DTA analysis on the performance of the whole-of-government Digital and ICT Portfolio.

Process

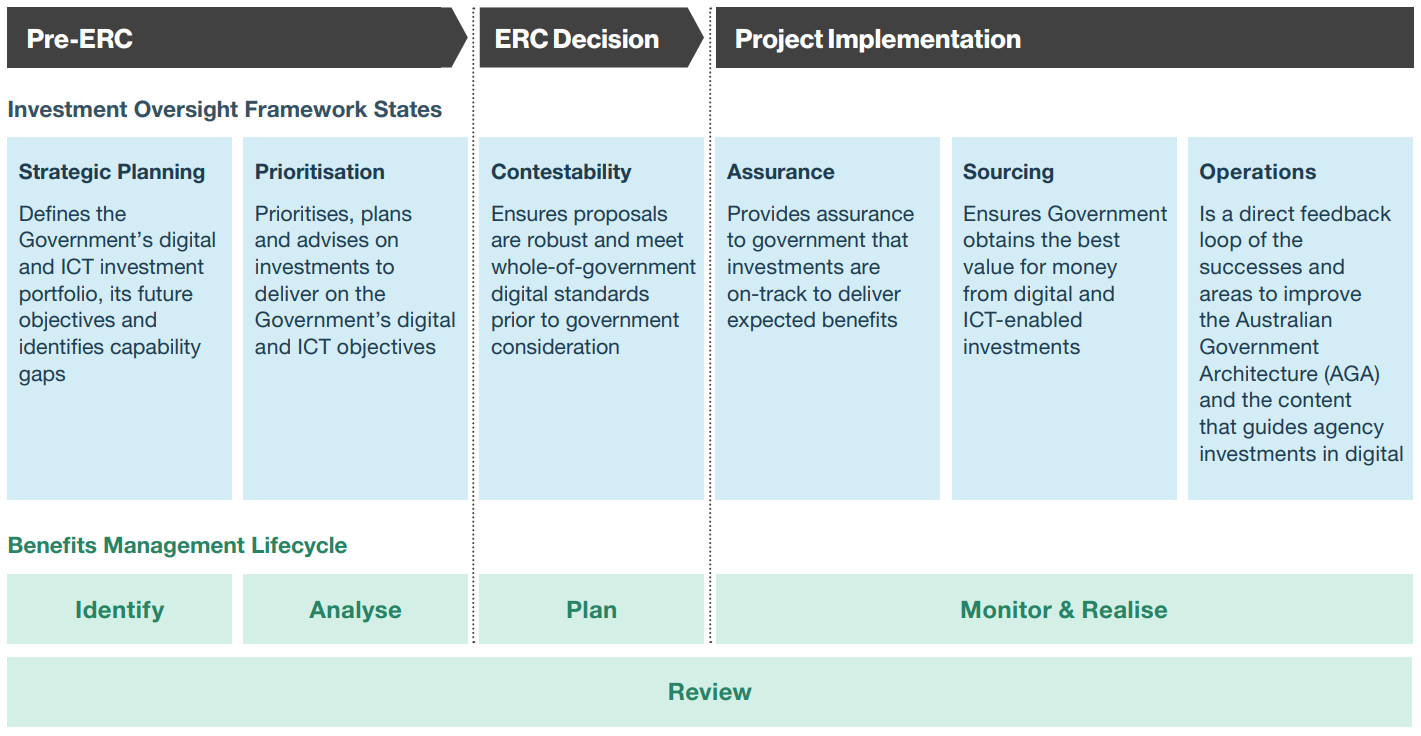

The benefits management lifecycle spans the life of a digital and ICT-enabled investment and beyond. The lifecycle comprises 5 key phases: Identify, Analyse, Plan, Monitor and Realise, and Review. While the lifecycle is represented as sequential, many activities are repeated throughout the lifecycle reflecting its iterative nature.

Image description

A diagram showing the Investment Oversight Framework States and Benefits Management Lifecycle for government digital and ICT investments. The image is divided into three main sections: Pre-ERC, ERC Decision, and Project Implementation.

Under 'Investment Oversight Framework States':

- Strategic Planning: Defines the Government's digital and ICT investment portfolio, its future objectives and identifies capability gaps.

- Prioritisation: Prioritises, plans and advises on investments to deliver on the Government's digital and ICT objectives.

- Contestability: Ensures proposals are robust and meet whole-of-government digital standards prior to government consideration.

- Assurance: Provides assurance to government that investments are on-track to deliver expected benefits.

- Sourcing: Ensures Government obtains the best value for money from digital and ICT-enabled investments.

- Operations: Is a direct feedback loop of the successes and areas to improve the Australian Government Architecture (AGA) and the content that guides agency investments in digital.

The 'Benefits Management Lifecycle' is shown underneath and consists of five stages.

- Identify

- Analyse

- Plan

- Monitor & Realise

- Review

The lifecycle stages are aligned with the main sections of the framework, with 'Identify,' 'Analyse,' and part of 'Plan' falling under Pre-ERC, the rest of 'Plan' under ERC Decision, and 'Monitor & Realise' under Project Implementation. 'Review' spans across all three main sections.

OffStages of the lifecycle

Identify

In the Identify stage, potential benefits are identified and prioritised. The objectives are:

- Understand the issues and opportunities that are driving the need for change.

- Consider these drivers together with strategic objectives to guide the identification of potential benefits and disbenefits.

- Prioritise the most achievable benefits and quantify them (consider applying the 80:20 rule).

- Map the benefit dependencies that enable benefits realisation.

- Capture baseline levels of current performance.

- Identify and validate benefits with potential Benefit Owners.

Analyse

In the Analyse stage, benefit forecasts are refined, benefits are valued, and options are assessed.

The objectives are:

- Further refine, validate and challenge benefit forecasts, and document any associated assumptions.

- Value benefits in monetary terms where possible to provide a consistent basis for assessing different options.

- Appraise the different options through techniques such as cost-benefit, cost-effectiveness, and multi-criteria analysis.

- Analyse benefit confidence and conduct sensitivity analysis.

Plan

In the Plan stage, mechanisms are put in place to document, realise and monitor benefits.

The objectives are:

- Further refine, validate and challenge benefit forecasts. Document associated assumptions.

- Confirm Benefit Owners, finalise roles, responsibilities, and governance arrangements.

- Record benefit dependencies and milestones in project plans.

- Seek out, identify and capture emergent benefits.

- Plan stakeholder engagement and communication.

- Document benefits management planning in benefit maps, benefit profiles, and benefits realisation plans.

Note: Benefits management documents, like business cases, capture ‘point-in-time’ requirements. However, these documents are live artefacts that must be regularly updated to reflect change throughout the investment lifecycle.

Monitor and realise

In the Monitor and Realise stage, benefits management remains central to investment delivery.

The objectives are:

- Seek out, identify and capture emergent benefits.

- Manage benefit variations via governance arrangements and change control mechanisms.

- Report periodically on benefits realisation progress and take corrective action where required.

- Implement business change management processes to ensure successful benefits realisation. This includes training and development, business process re-engineering, and/or staff redeployment.

- Adopt behavioural change strategies to maximise benefits.

- Formally handover responsibility for benefits realisation, optimisation and monitoring to Benefit Owners at project closure.

Review

The Review stage assesses the degree to which benefits are, or will be realised. Review occurs before, during, and after investment completion.

The objectives are:

- Conduct internal and independent reviews at key project and benefits management lifecycle milestones, including project stage gates, to assess the progress, delivery risk and realisation of benefits.

- Capture anecdotes and success stories that demonstrate success of the investment.

- Capture lessons learned and share with future investments.

- Continue to monitor and report on benefits realisation.

Glossary

Baseline: A measure of the current state, prior to implementing a change.

Benefit: The measurable improvement from change, which is perceived as positive by one or more stakeholders, and which contributes to organisational (including strategic) objectives.

Benefit Dependencies: Enabling products/services/outputs and business changes upon which benefits realisation is dependent (may also include intermediate benefits).

Benefits Management: The identification, quantification, analysis, planning, tracking, realisation, and optimisation of benefits.

Benefit Owner: The individual responsible for the realisation of a benefit and who agrees the benefit profile.

Benefit Profile: The document used to record and reach agreement (with the Benefit Owner) on the key details about a benefit (or disbenefit) including categorisation, measures, calculation, baseline, target, and any dependencies.

Benefits Realisation Plan: The plan that provides a consolidated view of the forecast benefits and the baselines against which benefits realisation can be monitored and evaluated. Should also capture governance arrangements, risks to realisation, and assumptions.

Benefits Map: A pictorial representation of the business changes on which benefits realisation depends, and how these benefits contribute towards strategic objectives.

Business Changes: Business changes or other management interventions (e.g. training, staff re-allocation, process redesign, etc.).

Business as Usual: The routine, day-to-day operational activities by which an organisation pursues its mission.

Cost-Benefit Analysis: Analysis which quantifies in monetary terms as many of the costs and benefits of a proposal as feasible.

Cost-Effectiveness Analysis: Analysis that compares the cost of alternative ways of producing the same or similar outputs. Suited to compliance-based projects.

Digital & ICT Portfolio: The collection of digital and ICT-enabled investments that are subject to the Investment Oversight Framework.

Disbenefits: The measurable result of a change, perceived as negative by one or more stakeholders, which detracts from one or more organisational (including strategic) objectives.

Emergent Benefits: Benefits that emerge during the design,development, deployment, and application of the new ways of working, rather than being identified at the start of the investment.

End Benefits: The benefits an investment is set up to realise and which confirm achievement of the investment objectives.

Intermediate Benefits: Benefits which arise during the benefits management lifecycle, and which can in turn enable the realisation of the end benefits that the investment was designed to realise.

Investment Oversight Framework: The Whole-of-Government Digital and ICT Investment Oversight Framework is a six-stage, end-to-end framework providing a way for the Government to manage digital and ICT-enabled investments across the entire project lifecycle.

Measures: One or more agreed measurable performance indicators used to demonstrate the achievement of a benefit.

Multi-Criteria Analysis: A technique applied to the appraisal of options. It is based on assigning weights to relevant financial and non-financial criteria, and then scoring options or investments in terms of how well they perform against these criteria.

Outputs: The tangible or intangible artefacts produced, constructed, or created as a result of a planned activity.

Senior Responsible Official (SRO): The Senior Executive Service (SES) official accountable for programme/project success, who ensures that benefits are realised post investment closure.

SMARTAA: Specific, measurable, achievable, realistic, timely, agreed, and attributable to strategic objectives.

Top-Level Benefits: Top-level benefits are the highest priority benefits that capture the intent of the investment and will provide the clearest evidence that an investment has achieved its stated aims. As a guide:

- Tier 1 proposals should generally articulate between 1 and 5 top-level benefits.

- Tier 2 proposals should generally articulate between 1 and 3 top-level benefits.

- Tier 3 proposals should generally articulate 1 to 2 top-level benefits.

Acknowledgments

This BMP draws on global experience and learning. It is predominantly based on APMG-International’s Managing Benefits™ methodology and definitions. This Policy builds on learnings from a robust discovery process, engagement with numerous entities in Australia and overseas, and draws on extant literature and best practice publications. The following best practice sources are gratefully acknowledged:

Jenner, S and APMG International, Managing Benefits: Optimizing the Return from Investment. 2014

Infrastructure and Projects Authority (UK Government), Guide for Effective Benefits Management in Major Projects. 2017

The Treasury, New Zealand Government, Managing Benefits from Projects and Programmes: Guide for Practitioners. 2019

Australian Taxation Office, Benefits Management Framework. 2020

Australian Bureau of Statistics, Benefits Management Framework. 2020

New South Wales Government, Benefits Realisation Management Framework. 2020

IP Australia, Benefits Management Framework. 2015

Axelos, Managing Successful Programmes (MSP®) 5th Edition. 2020

Services Australia, Benefits Realisation Manual. 2022

Contact and Feedback

Please contact us for further information. We value your feedback and ideas to help improve our processes and information. If you have any comments regarding this document, please share your thoughts with us: benefits.management@dta.gov.au

Assurance Framework for Digital and ICT Investments

Australian Government digital and ICT investments are funded and delivered within a Digital & ICT Oversight Framework designed to ensure investment objectives are achieved.

As part of this, the Assurance Framework for Digital and ICT Investments supports agencies in planning and implementing fit for purpose assurance arrangements.

Further information

Assurance Plan Templates and Guidance

Guidance documents including Assurance Plan templates and samples for Tier 1, Tier 2 and Tier 3 investments are also available on request from the DTA.

Benefits Management Policy

The Benefits Management Policy (BMP) defines how benefits must be managed across the Australian Government digital and ICT portfolio. The Policy supports agencies to deliver digital and ICT outcomes by detailing investment oversight requirements and providing guidance on benefits management.

The BMP ensures that agencies understand the requirements to successfully deliver the outcomes that Australians need by enabling effective oversight and reporting of investment outcomes across the Government’s digital and ICT investment portfolio

Contacts and Feedback

For further information and the latest versions of the DTA’s guidance documents and templates please visit Assurance.

You can also contact us about the following topics:

- Proposed investments: investment@dta.gov.au

- In-flight investments: portfolio.assurance@dta.gov.au

- Benefits management: benefits.management@dta.gov.au

We also value your feedback and ideas to help improve our processes and information. If you have any comments regarding this document, please share your thoughts with us at portfolio.assurance@dta.gov.au

Purpose and scope

The Australian Government’s Assurance Framework for Digital and ICT Investments (the Assurance Framework) ensures a robust assurance regime is achieved and maintained for in-scope investments.

While assurance is not in itself responsible for delivering outcomes, effective risk management and assurance are critical to good governance and ensuring investments deliver expected outcomes.

Scope

The Assurance Framework must be adhered to if both the following apply:

- Your agency is a Non-Corporate Commonwealth Entity

- Your agency’s proposed investment meets the definition for a digital or ICT investment.

As a guiding principle, a digital or ICT investment is an investment which uses technology as the primary lever for achieving expected outcomes and benefits. This includes investments which are:

- transforming the way people and businesses interact with the Australian Government

- improving the efficiency and effectiveness of Australian Government operations, including through automation.

The Digital Transformation Agency determines whether your investment meets the definition of a digital or ICT investment. If you are unsure whether your investment meets this definition, you must contact investment@dta.gov.au.

Even if this framework does not apply to your agency or to your investment, agencies are encouraged to follow the 5 Key Principles for Good Assurance and apply the framework to the extent it is relevant to your circumstances.